Dubai is well-known for its gorgeous architecture and cutting-edge design when it comes to new projects. Over time, it has undergone a spectacular transformation. In particular because it was moved from a sleepy fishing village to a bustling city that welcomes tourists from all over the world.

- Dubai Creek Tower

- Marsa Al Arab

- Burj Binghatti

- Agri Hub District

- One Za’abeel Ciel

- Dubai Urban Tech

- Dubai Wasl

- Dubai Tower

It is not surprising that Dubai is currently home to some of the most stunning and ambitious megaprojects ever! Let’s now take a closer look at Dubai’s top most anticipated projects for 2023, as well as their locations.

- The Dubai Creek Tower

Dubai Creek Harbour is the location.

if your standards exceed those of the Burj Khalifa. Your goals will be met by this project. The tallest structure in the world, Dubai Creek structure, will undoubtedly entice many people to visit.

The Tower was the name they chose for it initially, however Dubai Creek Tower was later added. Emaar oversees the majority of Dubai’s newest projects. It makes sense that it is the one who built this stunning structure.

The location of this marvel will be in the center of Dubai Creek Harbour. This is a well-known location within the Emirate.

2. The Marsa Al Arab

Location: South of Dubai

Marsa Al Arab is a brand-new construction that will divide the Burj Al Arab into two artificial islands.

The project is now under construction and will have a variety of attractions, including a luxury resort, a theater, a marine park, and more. A helipad, a yacht club, and a private marina will also be included in Marsa Al Arab.

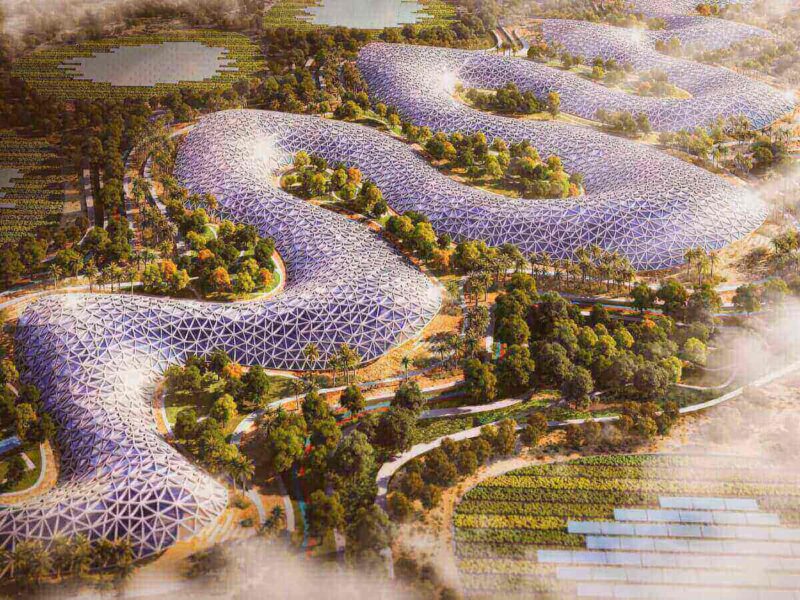

3. Burj Binghatti

Location: of Business Bay

One of the most well-known planned developments in Dubai’s Business Bay neighborhood is the Burj Binghatti. The tower is 200 meters high. Additionally, it provides 181 opulent apartments, ranging in size from studios to three-bedroom homes.

It stands out as a highlight in the city’s skyline due to its distinctive honeycomb design. with first-rate features and a good location. In Dubai, Burj Binghatti has grown to be a highly sought-after address for urban life.

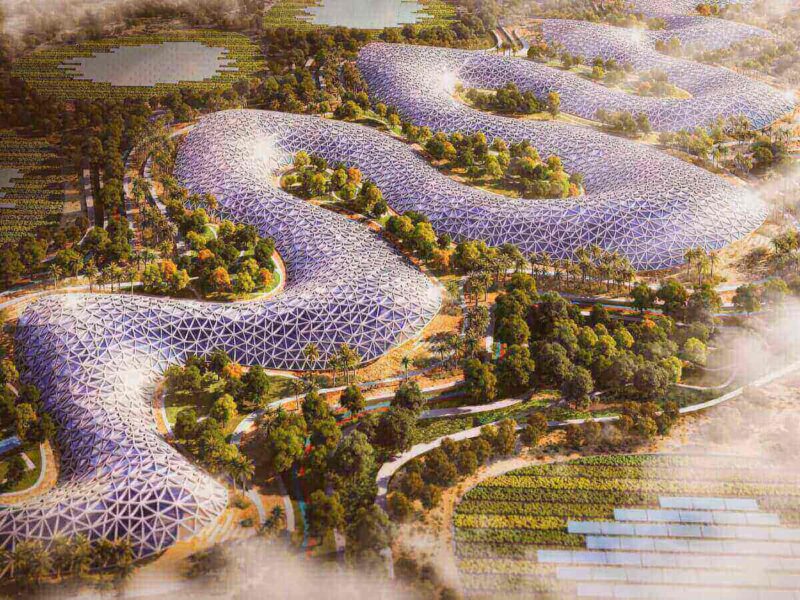

4. Agri Hub by URB

Location: the Al Barari

An upcoming project called Agri Hub by URB is now being built. Additionally, this ground-breaking project aspires to establish an urban agricultural neighborhood that is environmentally responsible and sustainable.

It is situated in a desirable area. Residents will have access to fresh fruit and a distinctive living environment thanks to Agri Hub by URB. This project is groundbreaking in the field of urban development since it places a strong emphasis on sustainability and community.

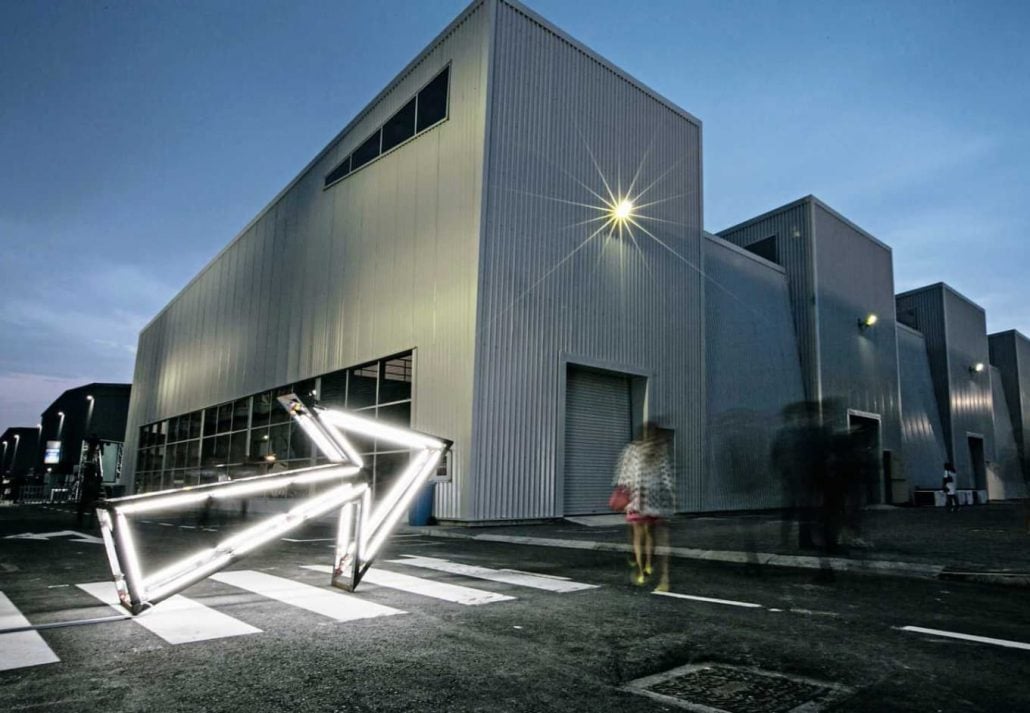

5. Dubai Urban Tech District

Location: Al Jaddaf neighborhood.

In actuality, Dubai Urban Tech District is one of the brand-new construction initiatives that will likely be finished by the conclusion of 2030. Additionally, this ground-breaking project aspires to establish a center for technology and innovation by uniting business owners, startups, and well-established corporations in a vibrant and cooperative community.

Dubai Urban Tech District is positioned to become a major hub for technology and innovation in the area thanks to its cutting-edge facilities and enviable location. It is a forthcoming initiative that is causing a lot of anticipation in the business and tech circles.

6. One Za’abeel

Location: Za’abeel area

If you want to view one of the most stunning architectural creations you’ll likely ever see. One Za’abeel fulfills all the requirements. It’s one of the upcoming developments in Dubai that will leave you breathless.

The Linx, the longest-ever cantilever bridge, connects two connected skyscrapers in this project. Additionally, the skyscrapers will include a stunning observation deck, a luxury hotel, residential apartments, and retail stores. Pay attention to this one!

7. City of Dubai Vertical

Vertical City, a zero-energy structure, has been suggested for development by Luca Curci Architects. This might bring something unique to Dubai’s famous skyline. This project, whose price tag is unknown, was initially announced in 2019 during the Knowledge Summit in Dubai. The Middle East is the suggested location for this project. And under the project proposal status, the client that is responsible for it is identified as a private organization.

An idea for a self-sustaining, water-based tower complex is called Vertical City. That has a maximum capacity of 25,000 people. The city also wants to implement a zero-waste strategy. Additionally, it will depend on renewable energy sources including solar energy, wind energy, and hydroelectricity.

8. Dubai Wasl Tower

Location : Sheikh Zayed Road

By Q2 of 2024, completion is anticipated. At more than 300 meters tall, the Wasl Tower dominates the skyline.

The 56th story of the Wasl Tower has reportedly had all structural construction done, and as of October 2022, the façade has advanced to level 13.

229 residential units, 258 hotel rooms, 185,345 square feet of office space, and 11 parking floors will be included in the tower’s 64 total floors. Additionally, the tower will appear to be looking in all directions because to its distinctive design based on the Z axis, which will provide the impression of dynamic mobility.

To sum up, Dubai’s forthcoming major projects are expected to completely change the city and solidify its status as a leader in tourism, real estate, and business worldwide. These initiatives will significantly increase the city’s already excellent infrastructure and skyline while also representing a significant investment in its future.

Here is a list of Dubai’s future intriguing new real estate projects that will further add to the emirate’s allure. Future events are imminent.

Dubai Ladies Club, often known as DLC, is a women-only beach club in Dubai that offers a ladies-only gym, spa, swimming pool, and even a room for beauty treatments. Additionally, this beach club frequently conducts activities for members only, such as fashion presentations, beach parties, and charity events.

Dubai Ladies Club, often known as DLC, is a women-only beach club in Dubai that offers a ladies-only gym, spa, swimming pool, and even a room for beauty treatments. Additionally, this beach club frequently conducts activities for members only, such as fashion presentations, beach parties, and charity events.