With its global ambitions restored thanks to a quick economic recovery following COVID, Dubai is vying for talent and investment to fuel long-term growth.

The opulent Gulf city-state’s strategy is a revamp of a flashy economic model that for years prioritized real estate investment, tourism, and money inflows from abroad.

Real estate is once again thriving, aided by Russian demand amid the conflict in Ukraine and looser residency regulations. Analysts believe that stronger safeguards are in place this time to prevent a recurrence of the issues that brought down Dubai following the global credit crunch in 2008.

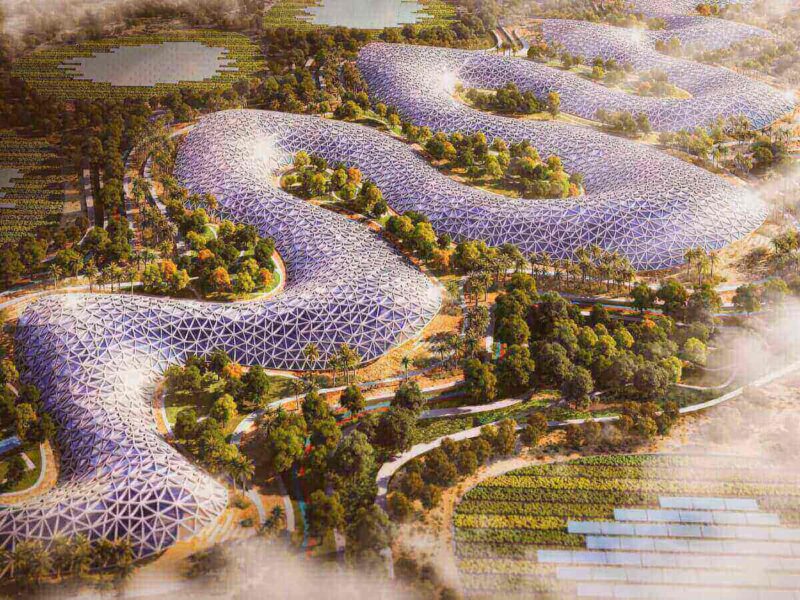

Dubai, home to the tallest building in the world and artificial islands, has ambitious new objectives: D33, a 10-year economic strategy, seeks to quadruple the size of the economy and elevate Dubai to one of the top four financial centers on the planet.

By 2040, it also plans to extend its public beaches from 21 kilometers to 105 km and revitalize the dusty Palm Jebel Ali island, which was abandoned after the 2008 financial crisis.

According to data by Knight Frank, with 219 home sales over $10 million in 2018, Dubai was the fourth busiest ultra-prime real estate market in the world. Tourist numbers are virtually back to levels of 2019.

In addition, the demand for ultra-high-end goods and the rise in real estate prices are bringing back regrets from earlier excesses.

Dubai was severely impacted by the global financial crisis in 2008, which resulted in a capital and population exodus, a collapse in real estate values, and highly leveraged flagship businesses known as government-related enterprises (GREs) that were having trouble paying off loans.

The oil-rich capital of the UAE, Abu Dhabi, eventually intervened with a $20 billion lifeline that is generally anticipated to be renewed a third time.

Nasser Al Shaikh, who led Dubai’s finance division until 2009, told Reuters that there is a danger that Dubai would become an unaffordable place to live and that new construction must ensure that there is a sufficient supply of mid-range housing to fulfill demand as the population rises.

“If developers in the private sector are unable to accomplish that, then the government and GREs may have a bigger role to do that while keeping prices reasonable,” Shaikh added, alluding to the top businesses that have driven Dubai’s explosive rise.

According to official figures, Dubai’s population increased to about 3.55 million in 2022, up 2.1% from 2021 and 4% since 2020; S&P estimates it to surpass 4 million by 2026.

The possibility of a significant new round of borrowing (by GRE developers) based on irrational expectations for real estate sales exists, but Justin Alexander, director at Khalij Economics and Gulf analyst at GlobalSource Partners, is optimistic that this risk will be reduced as a result of lessons learned from previous cycles.

In response to an inquiry for comment on how its strategy ensures that growth is sustainable and not speculative, the Dubai Media Office did not provide a response right away.

In order to acquire funds and expand its financial markets, Dubai established a Debt Management Office in 2022, paid off or restructured certain outstanding debt, and announced intentions to sell government holdings in 10 enterprises. Last year, it mentioned four of those.

Shaikh claimed that current financial officials had gained knowledge from the past mistakes of last 15yrs.

“Dubai has a strategy today, and the growth of capital markets is a key aspect of Dubai’s overall financial idea, not only to generate liquidity and pay off debt but also to deepen capital markets inside the financial sector.”

Worldwide Safe Haven

Dubai, the economic hub of the United Arab Emirates, has invested heavily in corporate and social reforms as well as industries like digital technology. Unlike the wealthy capital Abu Dhabi, less than 2% of GDP is derived from oil.

According to real estate research firm CBRE, villa prices increased by almost 15% in Q1, driving up average real estate prices by 12.8%. Sales of villas have topped 2014 peaks. Behind India and the UK, Russian buyers were third in Betterhomes’ list of the top 10 purchasers for May.

According to Richard Waind, group managing director at Betterhomes in Dubai, “Dubai has really established itself as a global safe haven,” adding that it is secure for families, politically, and economically.

“The market is no longer speculative. This market is based on sincere investment. That, in my opinion, is a significant departure from what we witnessed in 2008–2009 and perhaps the most recent peak in 2014.

According to S&P, Dubai’s gross general government debt will decrease from 78% of GDP in 2020 to 51% of GDP, or approximately $66 billion, by the end of 2023. However, due to large non-financial GRE liabilities, the overall public sector debt will remain elevated at approximately 100% of GDP.

Dubai’s five-year credit default swaps, which measure the price of insurance against a default, fell to a record-low 66 basis points on March 8 of this year, a significant decline from the 316 basis points it achieved at its peak during the COVID-19 pandemic in 2020.

According to the 2022 Financial Times ‘fDi Markets’ study released last month, Dubai garnered an estimated $12.8 billion in FDI capital last year; FDI into Saudi Arabia was roughly 30 billion riyals ($8 billion).

Dubai’s infrastructure, schools, and hospitals continue to be in high demand despite increased competition from Gulf neighbors.