Cruz said he wants to achieve that goal in five years

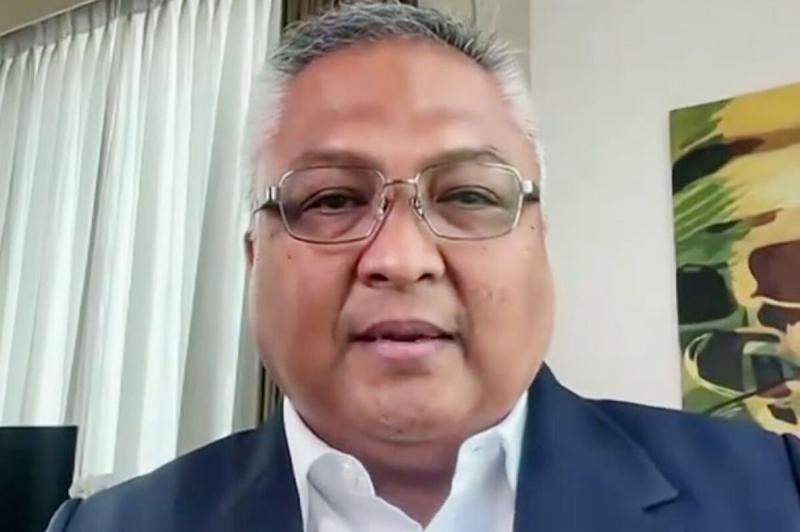

Globe Telecom Inc.’s new chief executive officer is targeting growth in the firm’s broadband and enterprise services units to hit a goal of becoming the Philippines’ biggest telco by revenue.

“The ambition is to be the largest, most profitable and most admired telco operator in the Philippines,” Carl Raymond Cruz said in an interview on Bloomberg Television Tuesday.

In a separate briefing, Cruz said he wants to achieve that goal in five years, fueled by growth in units that are currently trailing key competitor PLDT Inc.

“If you take a look where we came from in the last couple of years, we are number one in mobile. We are not yet there in broadband fiber and enterprise,” he said.

Globe is already the Philippines’ biggest telecom firm by market value, but main rival PLDT — which has a larger enterprise business — is still no. 1 by revenue and is more profitable.

PLDT’s net income rose 21% last year to 32 billion pesos ($565 million), from revenue of 217 billion pesos. That compares with Globe’s net income of 24 billion pesos, with revenue of 181 billion pesos.

“Overtaking PLDT is not a distant possibility for Globe as it continues to innovate its services and expand its market reach,” said Peter Garnace, equity research analyst at Unicapital Securities Inc. “While Cruz will inherit a strong and agile telco behemoth built by his predecessor, he will also face a huge challenge of steering Globe through an increasingly competitive telco sector, underpinned by a fast-evolving digital needs of customers.”

Cruz, who previously led Airtel Nigeria and managed Unilever Plc’s West Africa business, was formerly Globe’s deputy CEO. Top of his to-do list in his new role will be the initial public offering of GCash, Globe’s ubiquitous mobile wallet, which he said may take place in the fourth quarter of this year or first half of 2026.

The IPO is expected to see GCash aim for a valuation of at least $8 billion. But it comes at a particularly volatile time as US President Donald Trump’s trade policies cloud the outlook for the global economy, and the Philippines’ stock market reels from low liquidity and weak valuations.

“We want to ensure that the macro environment, when we do the IPO, will be very conducive for this particular offering to be the most successful in the Philippine market,” Cruz said.