The research and management consultancy examined the condition of the Kingdom’s quick meals business in a recent report and found that a number of variables are coming together to fuel consumer demand for “ready-to-eat” food products.

The market for ready meals in Saudi Arabia had total sales of just over SAR 250 billion ten years ago. By the time the pandemic started, the market had grown year over year to a value of SAR 310 billion. The total sales will have surpassed SAR 330 by the end of the next year.

One of the key factors driving demand is convenience, since busy lifestyles amongst corporate and working-class people and an increase in the number of working women leave people with less time to cook meals after work hours. Meals that have been prepared in advance and are ready to eat can be made more quickly and conveniently.

According to Glasgow Consulting Group’s analysis, another growth driver is the increasing maturity of supply side dynamics, which is backed by a maturing infrastructure and distribution network in supermarkets, shopping malls, and other establishments that stock ready meals.

Producers of prepackaged meals are contributing to encouraging uptake in the meantime. The researchers claim that ready-meal packaging has improved over time, becoming more convenient (like bulk packing) and appealing to customers. Producers are also more engaged in the segment overall when it comes to marketing and promotions.

One fifth of revenue is produced outside of the consumer segment (which is responsible for 80% of ready meal sales). This sector covers corporations and enterprises who serve ready meals to their employees during working hours.

The area also includes prepared meals distributed by the government during major events like the Hajj pilgrimage and chilled lunch kits at schools, one of the industries with the quickest growth rates, according to the research. The business segment is anticipated to increase from less than SAR 60 billion five years ago to SAR 66 billion by 2023.

Two specialized markets are becoming more well-known across the two quick meal markets. In contrast to ready meals’ long-standing reputation for being unhealthy, health-conscious recipes are currently popular, and often include natural and health-improving components.

Another area that is making improvement is sustainability. Food makers are making better products—free of artificial additives and preservatives—and greening their packaging, which is satiating the appetites of more and more environmentally and health-conscious consumers.

Frozen foods

Both frozen and chilled foods are generally anticipated to develop at comparable rates within the ready meals sector. Produce that has been purchased and promptly stored in a freezer (-18°C or lower) is referred to as frozen food. Meat, fish, poultry, pasta, veggies, and fruits are a few examples of foods that are frequently frozen.

Instead of being frozen, chilled food items are kept fresh and safe in the refrigerator (not the freezer) (often at a temperature of between 0 and 5 degrees). Despite the fact that microbes cannot thrive at temperatures below -9.5 °C, frozen products do not need preservatives, but chilled food must.

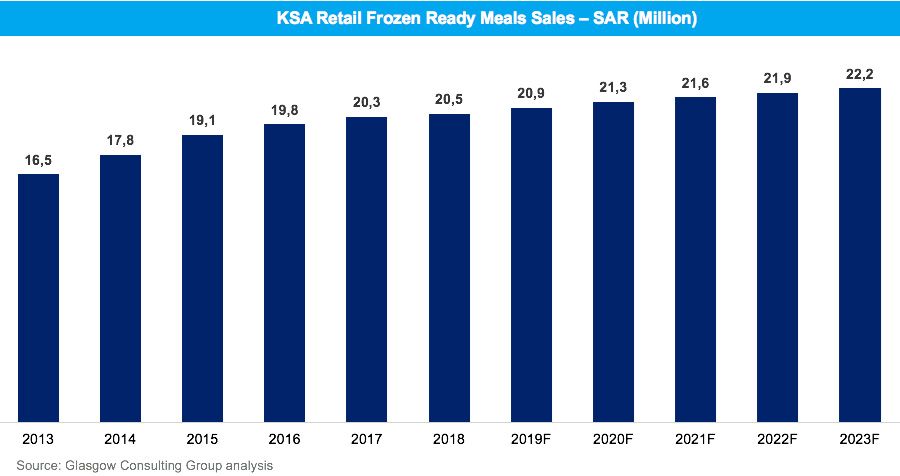

The frozen food segment, now valued at SAR 21.6 billion (with usage at about 500 tonnes), is anticipated to reach SAR 22.2 billion by 2023. Growing food diversity in the supply, increased accessibility throughout the food retail network, and producer-push initiatives all support rising demand.