Dubai’s real estate market has continued its buoyant start until 2025, registering total sales worth 142.7 billion in Q1, the second highest registered quarterly figure.

This represented an annual leap of 30.3% in the value, while the 45,485 general sales transactions also meant an annual increase of 22.8%.

An update of the market issued today by Fäm Properties revealed that the results of the first quarter were only fractionally in the quarterly sales record of all time of 147.2 billion transactions of 50,218 in the fourth quarter of 2024.

The first quarter of 2025 saw important year -on -year increases in all real estate sectors, directed by a 193.8% jump in the sales of the plot worth AED35.5 billion of 2,926 transactions.

Dxbinteract data show that Villas sales increased by 43.1% year -on -year to AED41.3 billion from 8,369 agreements, while apartments sales increased by 12.6% to 62.3 billion 32,884 transactions. Commercial sales also increased by 25.2% to AED3.6 billion of 1,212 agreements.

The increase in the values of the properties in recent years stood out for an average price Q1 of AED 1,563 by square feet, compared to the Q1 rates of AED 889 in 2021, AED 1,124 in 2022, AED 1,283 in 2023 and AED.

“Once again, we are seeing figures that empathically underline the remarkable resistance and strength of Dubai real estate marketAs the constant growth of recent years continues, “Firas told MSADDI, CEO or Fäm properties.

“This upward trend supported the position of Cementos Dubai as a main real estate investment center, which attracted global investors to global investors throughout the strong demand for local and regional buyers.”

Dubai Q1 property sales in the last five years have now increased to the current level of 21 billion AED (9,800 transactions) in 2020 to AED 24.6 billion (11,600) in 2021, 54.6 billion (20,100) in 2022, AED 89 and 89 billion (37,000) last year.

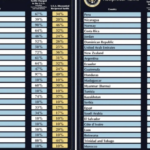

Dubai’s main performance areas in terms of volume in Q1 were:

- Jumeirah Village Circle: 3,605 transactions valued at AED 4,559 billion

- Wadi al Safa: 3,596 valued transactions of AED7,642 billion

- Business Bay: 2,782 transactions valued at AED 7,265 billion

- Dubai South: 2,676 transactions valued to AED 8,745 billion

- Dubai Marina: 2,583 transactions valued at AED9,284 billion

The most exhaustive individual property sold in Q1 was a luxury villa in Dubai Hills Estate that obtained 140 million AED. The most exensive apartment that sold the quarter was for 116 million AED in rings 1 in Jumeirah Segundo.

With properties worth1-2 million that represent 31% of sales (14,242), 26% (11,899) were below AED1 million, 19% (8,567) between AED2-3 million, 15% (6,837) between AED3-5 million and 9%.

In general, the first sales of the developers significantly exceeded the coatings in the secondary market-65% approximately 35% in terms of volume and 61% against 39% in value.