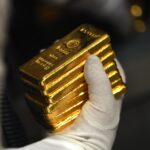

Gold prices fell sharply on Wednesday after the president of the United States, Donald Trump, withdrew from threats to fire the president of the Federal Reserve, Jerome Powell, and the Treasury official, Scott Besent, pointed out a possible flexibility of commercial tensions of the United States-China.

Spot Gold fell 1.2% to $ 3,340.92 an ounce for 0013 GMT, while US Gold Futures fell 2% to $ 3,349.20.

The retirement follows a historical manifestation, where gold increased to a maximum of all time above $ 3,500 per ounce on Tuesday, marking its 28 record record this year.

Trump softened his position against the Federal Reserve after days of strong criticism, and expressed optimism that a commercial agreement with China could “substantially” reduce tariffs. Separately, Scott Besent said that while negotiations with Beijing have not yet begun, he expects a decalcage in tensions, although conversations are likely to be a “work.”

The US dollar also recovered slightly from a minimum of three years, which makes gold more exnsus for holders or other currencies.

Despite Wednesday’s decline, the feeling of the market around gold remains optimistic. JP Morgan projects that gold prices could exceed the milestone of $ 4000 for essence next year, driven by persistent global uncertainties and expectations of lower interest rates.

In other parts of the precious metal market, Spot Silver increased 0.2% to $ 32.58 to Ount, platinum fell 0.6% to $ 952.65, and Palladium decreased 0.4% to $ 931.91.

Meanwhile, investors are closely seeing a series of economic data launches today, including manufacturing and PMI Services flash in Japan, France, Germany, the Eurozone, the United Kingdom and the US. UU., Together with the new housing sales data for March.

![]() Follow Emirates 24 | 7 on Google News.

Follow Emirates 24 | 7 on Google News.