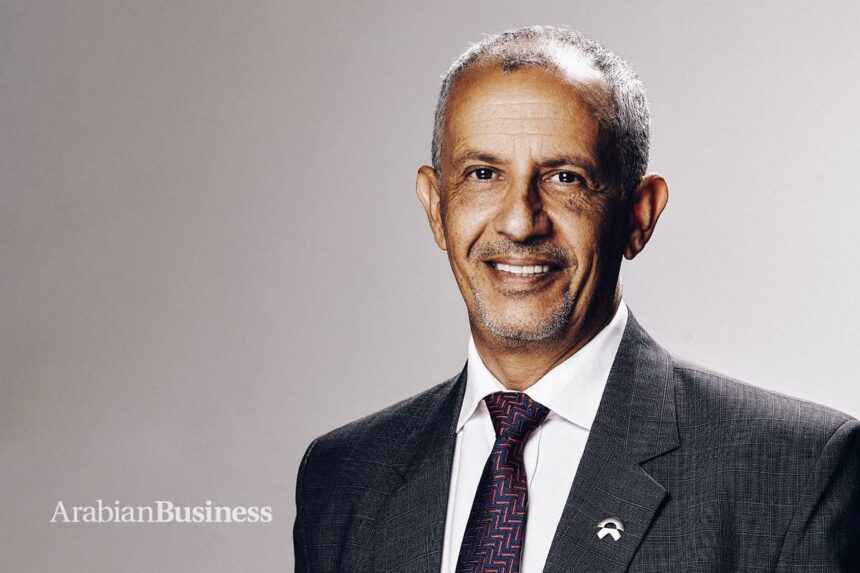

At the gleaming NIO flagship on Al Maryah Island, Maktari speaks with measured precision about the task at hand. “We are building the NIO network in the MENA region, starting in the capital of the UAE,” he tells Arabian Business, his voice steady and unhurried. It’s only his seventh month as CEO of NIO MENA, but his demeanour suggests decades of preparation for this moment.

The 970-square-metre space opened last November, marking NIO’s first foray into the Middle East and North Africa. With its understated luxury, designer café serving saffron-infused beverages, and minimalist display of electric vehicles, it feels less like a car showroom and more like an exclusive members’ club – a physical embodiment of Maktari’s vision for the brand.

But what truly sets NIO apart isn’t visible inside this polished retail space. It’s the technology that Maktari believes will fundamentally transform how Gulf consumers think about electric mobility: battery swapping.

“The first Power Swap Station in MENA went operational last month in Abu Dhabi,” Maktari explains. “Within minutes, drivers can replace their depleted battery with a fully charged one – no waiting for charging, no range anxiety, just swap and go.”

For Maktari, who previously led operations for luxury brands like Lexus and managed dealership networks for Al Ghurair Motors, this represents the culmination of a career-long conviction that the future of Gulf mobility would eventually transcend traditional combustion engines. But even he admits the pace of the transition has surprised industry veterans.

The electric tide

The Gulf’s rapid embrace of electric vehicles represents a striking paradox. In a region built on oil wealth, Chinese EV manufacturers are making unprecedented inroads. Tesla, once the undisputed EV leader in the UAE with over 40 per cent market share in 2022, has seen its position erode to just 16 per cent by early 2025, as companies like BYD and NIO have rapidly expanded their presence.

A drive down Dubai’s Sheikh Zayed Road tells the story visually – where luxury European brands and American muscle cars once dominated, now sleek Chinese EVs from BYD, NIO, and XPeng weave through traffic with increasing frequency. At premium hotel valet stations and shopping mall parking garages, these new entrants aren’t relegated to the corners but occupy prime spots, a visible symbol of the market’s transformation.

“The regional market has been ready for high-quality EVs for some time,” Maktari observes. “What’s changed is the maturity of the technology and the availability of options that truly meet the high expectations of Gulf consumers.”

NIO’s entry into the region was formalised last October in the presence of UAE President Sheikh Mohamed bin Zayed Al Nahyan and Egyptian President Abdel Fattah El-Sisi. The company established a joint venture with Abu Dhabi-based CYVN Holdings, a major investor in advanced mobility, to launch NIO MENA. The deal wasn’t merely about selling cars – it encompassed plans for a research and development centre in Abu Dhabi focused on autonomous driving and artificial intelligence.

“We’re not just bringing vehicles to market,” Maktari says. “We’re establishing a comprehensive ecosystem that includes R&D, charging infrastructure, battery-swapping networks, and a completely different ownership experience.”

This is where NIO’s approach diverges significantly from competitors. While BYD has captured market share through aggressive pricing and Tesla has relied on its brand cachet, NIO is betting on a premium experience coupled with technological innovation – specifically, its proprietary battery-swapping network.

The global power swap

What’s unfolding in the UAE mirrors a broader shift in the global automotive landscape – a genuine “power swap” that extends far beyond battery technology. For a century, the industry’s centre of gravity has been firmly anchored in the West, with American, German, and Japanese manufacturers dictating innovations and setting standards. That era is rapidly changing.

China’s EV market dominance has soared over the past few years, with Chinese brands making significant inroads across global markets. In the Middle East, this trend is particularly pronounced, with Tesla’s once-dominant position slowly giving way to Chinese competitors.

This changing of the guard isn’t merely about market share. It represents a fundamental reordering of industrial capability and technological expertise. Chinese manufacturers have rapidly advanced their EV architecture and battery technology while simultaneously securing the critical mineral supply chains needed to power this revolution.

For the Gulf markets, historically aligned with Western automotive preferences but increasingly integrated with China’s economic orbit, this transition creates both opportunity and complexity – with NIO positioned at the nexus of this transformation.

The swap solution

In a region where temperatures regularly exceed 45°C (113°F) in the summer months, battery performance and degradation represent significant concerns for potential EV adopters. NIO’s answer is to separate the battery from the vehicle ownership equation.

Last month’s milestone – the first operational Power Swap Station in the UAE – represents just the beginning of an ambitious infrastructure rollout. According to NIO’s global plans, by December 2025, more than 2,300 county-level divisions across 27 provincial-level administrative regions in China will be covered by swap stations. While specific MENA targets have not been announced, the infrastructure development is clearly on an accelerated timeline.

Battery swapping addresses several key challenges simultaneously. It eliminates range anxiety, reduces degradation concerns in the extreme climate of the Gulf, and brings the refuelling experience closer to what traditional drivers expect – a few minutes and you’re back on the road.

The concept has already proven enormously popular in China, where NIO reported over 130,000 daily battery swaps during this year’s Chinese New Year holiday. For a region accustomed to premium service and minimal inconvenience, this approach could prove decisive in accelerating EV adoption.

The timing of NIO’s regional expansion coincides with a strategic partnership between NIO and Contemporary Amperex Technology Co. (CATL), formalised earlier this month. CATL, the world’s largest battery manufacturer, is investing up to approximately $345 million in NIO Power, further strengthening the company’s battery-swapping capabilities.

The luxury equation

While much of the EV conversation globally has focused on affordability and mass-market adoption, NIO has taken a different approach – one that aligns perfectly with the Gulf’s luxury-oriented consumer base.

The MENA region has long been receptive to premium automotive brands, with Maktari’s own career reflecting this reality through his leadership roles at Lexus and management of luxury dealership networks. NIO’s positioning in this space, with sophisticated design, cutting-edge technology, and exceptional service, resonates with local expectations.

Indeed, the competition in the regional EV space increasingly resembles a luxury arms race. Lucid Motors, backed by Saudi Arabia’s Public Investment Fund, opened a showroom in Dubai’s City Walk and has been delivering its Air luxury sedans to Saudi customers. BYD has introduced upmarket models like the AVATAR 11 SUV, starting at AED 250,000 ($68,000), positioning them not as budget alternatives but as premium technology showcases.

Yet Maktari’s team remains focused on NIO’s distinctive appeal. “The launch of NIO House in Abu Dhabi underscores our shared commitment to driving sustainable mobility and creating experiences that inspire and connect communities,” Maktari noted at the December inauguration.

This premium positioning represents NIO’s global strategy, not just a regional adaptation. The company reported increased vehicle margins of 13.1 per cent in Q4 2024, up from 11.9 per cent the previous year, bucking the industry trend of margin compression amid increased competition.

The China factor

NIO’s expansion unfolds against the backdrop of China’s rapidly growing dominance in the global EV market and the geopolitical race for control of the critical resources that power these vehicles.

The transformation of the automotive industry is evident in the market data. Despite having access to less than 25 per cent of the world’s lithium resources, Chinese companies control approximately 65 per cent of global lithium processing and refining capacity. This strategic positioning has given Chinese EV manufacturers a decisive advantage in the industry’s most transformative era.

The stakes couldn’t be higher. The global lithium market is projected to expand from $26.88 billion in 2024 to $134.02 billion by 2031, driven primarily by explosive EV growth. As traditional automotive powers struggle to catch up, China has secured its supply chain through aggressive investments across South America’s “Lithium Triangle” and emerging deposits in Africa – including major stakes in Zimbabwe’s Bikita lithium mine.

In the Gulf, this strategic advantage is already reshaping the market. Bilateral trade between the UAE and China exceeded $90 billion in 2024, up from $72 billion in 2022. China remains the UAE’s top non-oil trading partner, and advancing free trade negotiations signal further economic integration – creating an increasingly favourable environment for Chinese EV manufacturers.

For Maktari, whose career includes experience with diverse automotive brands ranging from Lexus to Chrysler to Chinese manufacturer ZNA, this evolution fits within his extensive industry experience. “The quality and technology of Chinese EVs today are world-class,” an observation that reflects the industry’s current reality rather than heritage-based assumptions.

This shift represents a profound realignment in the Gulf’s automotive landscape, traditionally dominated by Japanese, American, and European brands. Tesla, once the undisputed EV leader in the UAE with over 40 per cent market share in 2022, has seen its position erode to just 16 per cent by early 2025, as companies like BYD and NIO have rapidly expanded their presence.

The infrastructure imperative

The Gulf’s transition to electric mobility depends not just on appealing vehicles but on robust infrastructure. Both the UAE and Saudi Arabia have announced ambitious targets – the UAE aims to convert 50 per cent of government vehicles to electric by 2030, while Saudi Arabia targets 30 per cent of vehicles in Riyadh being electric by the same year.

Maktari views this government commitment as an important element in NIO’s regional strategy. The regional leadership has demonstrated clear vision regarding electrification and sustainability, and NIO’s investments align with these national priorities.

NIO’s partnership with CYVN Holdings provides significant advantages in navigating this landscape. CYVN, chaired by H.E. Jassem Mohamed Bu Ataba Alzaabi, brings deep regional connections and strategic investment capacity. The official inauguration of NIO House Abu Dhabi by Sheikh Zayed bin Hamdan bin Zayed Al Nahyan underscored the high-level support for the venture.

“The launch of NIO House in Abu Dhabi underscores our shared commitment to driving sustainable mobility and creating experiences that inspire and connect communities,” Maktari noted at the December inauguration.

The road ahead

Looking to the future, NIO’s ambitions extend far beyond its current vehicle lineup and initial infrastructure development. The company is establishing deeper roots in the region by building an R&D centre in Abu Dhabi focused on autonomous driving and AI technologies, while exploring manufacturing opportunities across the region, including in Egypt.

This comprehensive approach reflects NIO’s global ambition. As of February 2025, the company had delivered a cumulative total of 698,619 vehicles globally, with its premium NIO brand accounting for 667,897 units and its family-oriented ONVO brand contributing 30,722 vehicles.

The company’s financial trajectory appears equally promising. NIO reported total revenues of $9.01 billion for 2024, representing an 18.2 per cent increase from the previous year. Its ESG rating was recently upgraded to AA by MSCI, positioning it in the top tier of the global automotive industry.

“We are building the NIO network in the MENA region, starting in the capital of the UAE,” Maktari stated when discussing the company’s regional strategy. This focused approach, starting with establishing a strong presence in Abu Dhabi before expanding across the region, exemplifies the methodical expansion plan.

As the interview comes to a close, the company’s positioning seems well-calibrated to the market. In a region built on oil but rapidly embracing a sustainable future, NIO’s battery-swapping technology and premium experience appear perfectly aligned with local expectations.

The electric revolution transforming global mobility has arrived in the Gulf, and through NIO MENA, Mohammed Maktari is helping write its next chapter – one battery swap at a time.