The global economy faces growing recession threats as tariffs increase and commercial tensions deepen between the main economies, warns Nigel Green, CEO of the global financial advice giant Dover Group.

“The volumes of world trade are being reduced to the fastest rate from the financial crisis of 2008. Investors, companies and policy formulators should not be under illusions: a risk of global recession is growing day by day,” he says.

Recent data reveal a worrying image. The trade of global goods hired by 1.3% in the last quarter of 2024 compared to the previous year, cord about the latest world trade monitor figures.

At the same time, the global manufacturing activity continues to deteriorate, with main indicators that blink in red in multiple regions.

Nigel Green explains: “The rates imposed by the largest economies in the world are not only slowing down. They are eroding business confidence, cutting corporate investment plans and undulating through supply chains that had to go once the global global Global Growel Growel Growel Growel Growel Growel Global Global Global Gloral Growa being tight. “

The International Monetary Fund (IMF) has already reviewed its global growth forecast from 2025 down, citing “growing commercial restrictions” as a key factor.

In addition, the World Bank warned that protectionism threatens to eliminate the percentage point of global GDP only this year, pushing an already fragile global economy closer to contraction.

The CEO of the Devere group continues: “It is a dangerous feedback cycle. Commercial barriers lead to slower growth, which generates political pressure for even protectionism. We are witnessing the first stages of a vicious circle.”

The costs are starting to bite. Emerging marketsOr the first victims when global trade slows down, capital outputs accelerate. In advanced economies, export orders are falling, corporate profits are atomical and the loss of manufacturing jobs is increasing.

Financial markets are beginning to take note. Global values markets have become more volatile as fears on the reduction of world trade are deepened. Meanwhile, the coins of the main export nurses are under pressure, and Haven Seguros flows towards assets such as gold and the Swiss Franco are increasing.

“In an interconnected world, commercial interruptions spill rapidly across borders,” says Nigel Green.

“No economy is immune. Even those less dependent on exports will feel the pain as the investment slows down, the reconfigured supply chains and confidence evaporates.”

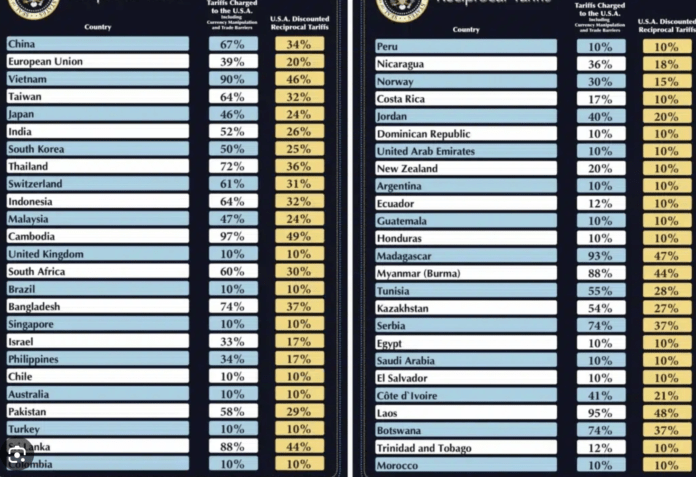

Checking the risks is the political backdrop. Recent movements by the United States, China and Europe to slapped tariffs on key imports, from steel and electric vehicles to agricultural products, indicate that global commercial war is not only far from being, but an intensive one.

“Political leaders seem more willing than ever to assemble trade by strategic objectives,” he says. “But the cost of these movements will finally be assumed by companies and consumers through higher prices, lower growth and inemple increase.”

He continues: “The world learned painful lessons duration of the 1930s on the destructive impact of Tit rates per eye. We would do well to remember them now.”

Despite the growing threats, Green believes that there are still opportunities for investors who are willing to think around the world and position themselves wisely.

“At higher risk, diversification is fundamental. Investors must be global in their perspective, diversified in their portfolios and disciplined in their strategies. Being still is not an option,” he says.

Green concludes with a call to action: “The warning signs are clear. Those who ignore them do so at their risk.

“As the drum of commercial wars becomes stronger, the world can be a new economic reality, one where resilience, forecast and adaptability become the final currencies of success.”